Every parent knows the dance when a child grazes their knee: the long build-up, the worry, the ‘are you ready?’ – only for the actual removal of the plaster to be far quicker and less painful than anticipated.

This year’s UK Budget followed a similar script.

Financial markets were primed for sharp, immediate tax rises. Commentators warned of fiscal tightening. Yet when the Chancellor delivered the measures, the initial reaction was muted. Markets barely moved. The plaster came off – and it didn’t hurt.

At least – Not yet!

Because beneath the calm surface lies a simple truth: this Budget raises taxes significantly – just not immediately.

The pain has been deferred into the future. And in doing so, the government has effectively given itself more room to borrow and spend today.

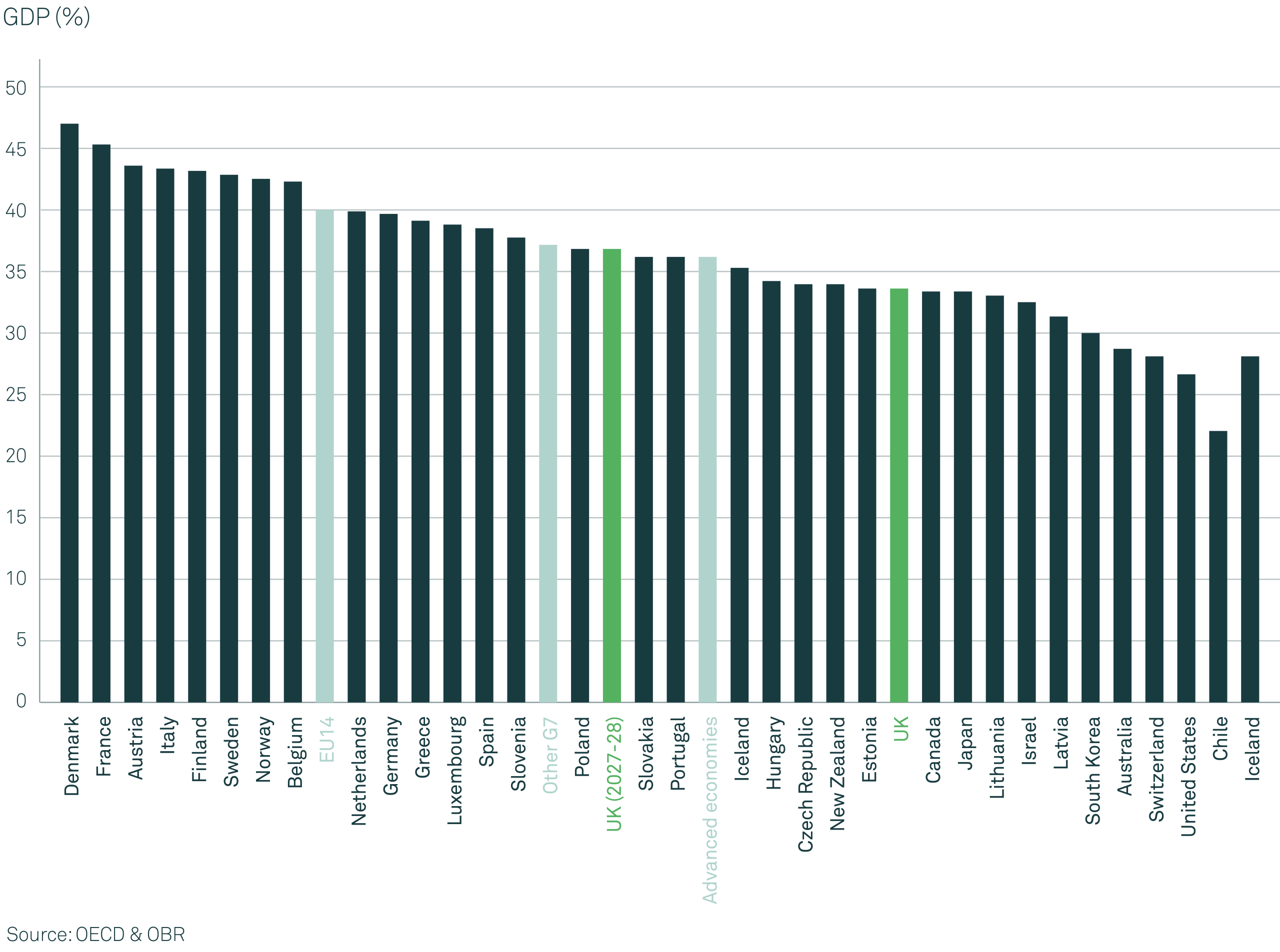

COUNTRIES & BLOCKS TAX TAKE

Note: Implied tax burden for the UK in 2027-28 is based on our latest forecast adjusted for the historical difference in outturn between the ONS and OECD since 2010. 2000 data are used for Japan and Australia.

A BUDGET BUILT ON FUTURE REVENUES

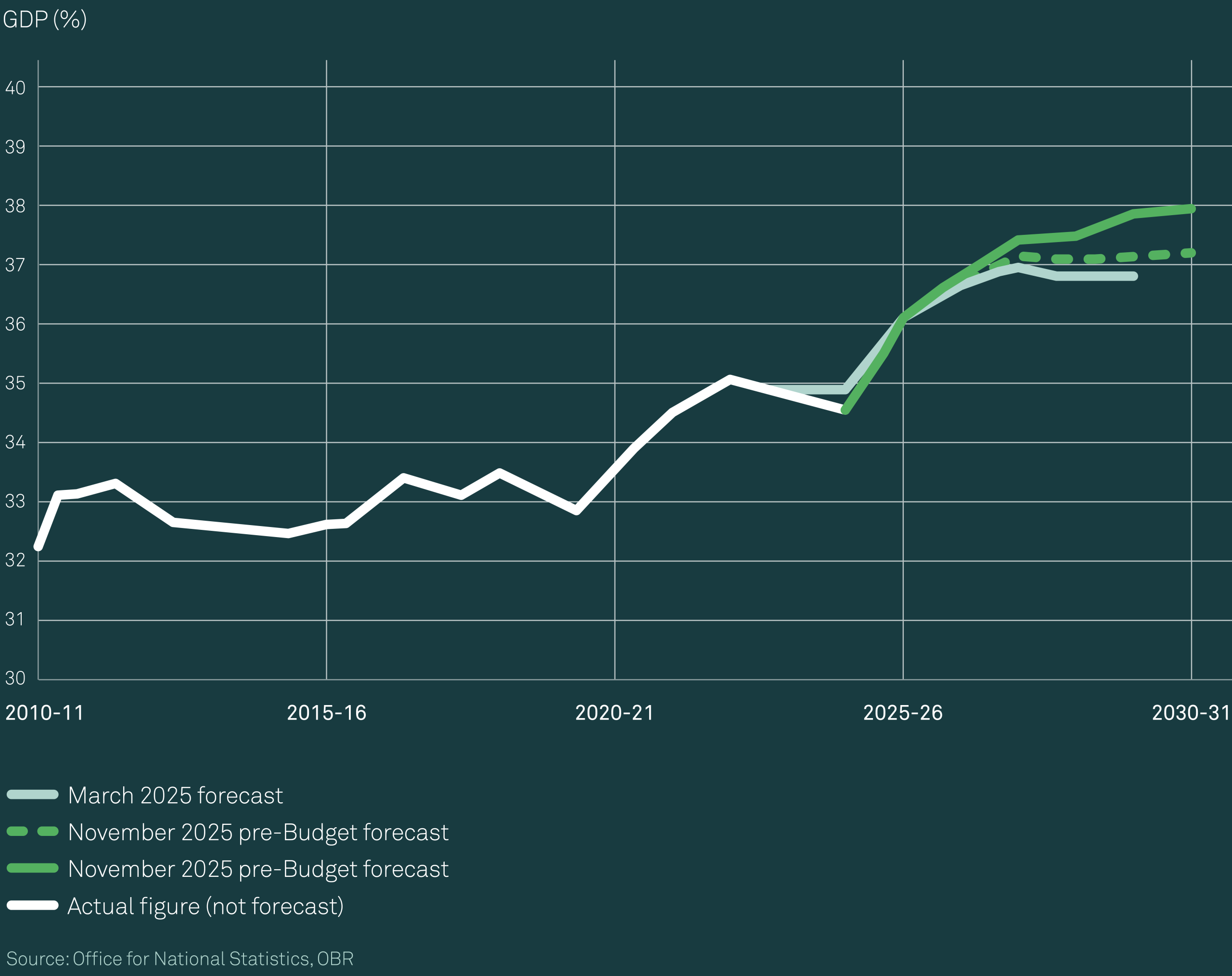

The Office for Budget Responsibility (OBR) now expects the UK’s tax take to rise from 34.7% of GDP (2024-25) to 38.3% by 2030-31 – a historic high.

TAX BURDEN SET TO SURGE

OBR forecasts for UK tax take as a percentage of GDP

This is a substantial shift in the UK’s fiscal position. The increase is not coming from headline Income Tax or VAT rises – politically explosive territory – but from a combination of less visible or delayed actions:

WHY DELAY? BECAUSE IT ALLOWS MORE BORROWING TODAY

This is the part that has received the least commentary – but arguably matters the most.

By announcing tax increases that come into effect later, the government has achieved two things simultaneously:

- Avoided an immediate hit to living standards

This reduces political friction and stabilises short-term economic expectations. - Signalled higher long-term revenues

This is crucial: markets assess the government’s ability to service its borrowing based on expected future income, not just today’s.

In other words: deferred tax increases expand the government’s fiscal headroom now.

It is effectively saying to the bond markets: “We will take more from households and investors later, so we can spend more today.”

This helps explain why public spending commitments can rise even as the country remains highly indebted.

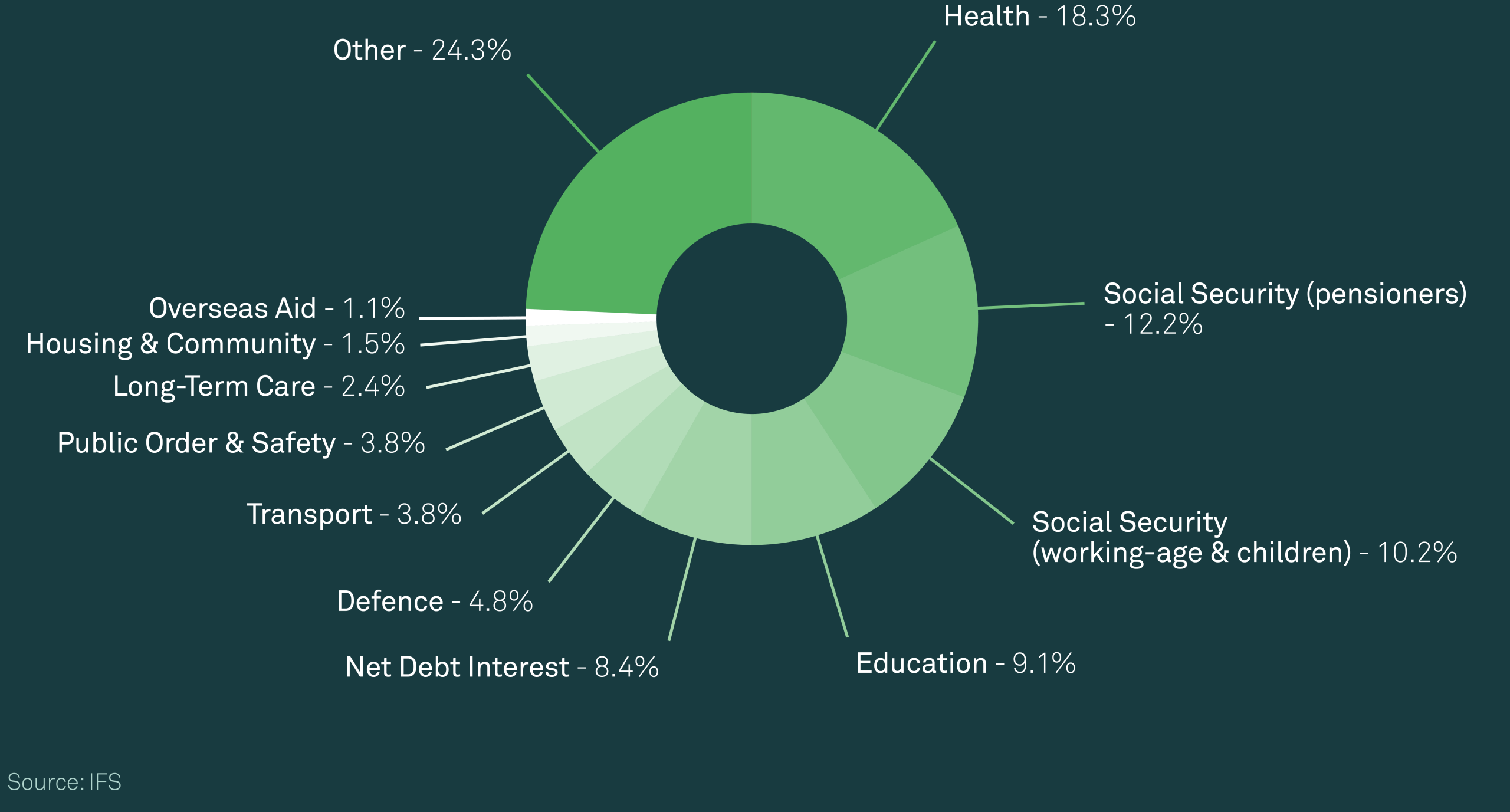

WHERE DOES UK TAX MONEY ACTUALLY GO?

Investors often ask a simple question: “What are we paying for?”

Below is the broad picture of where the UK spends its tax revenue.

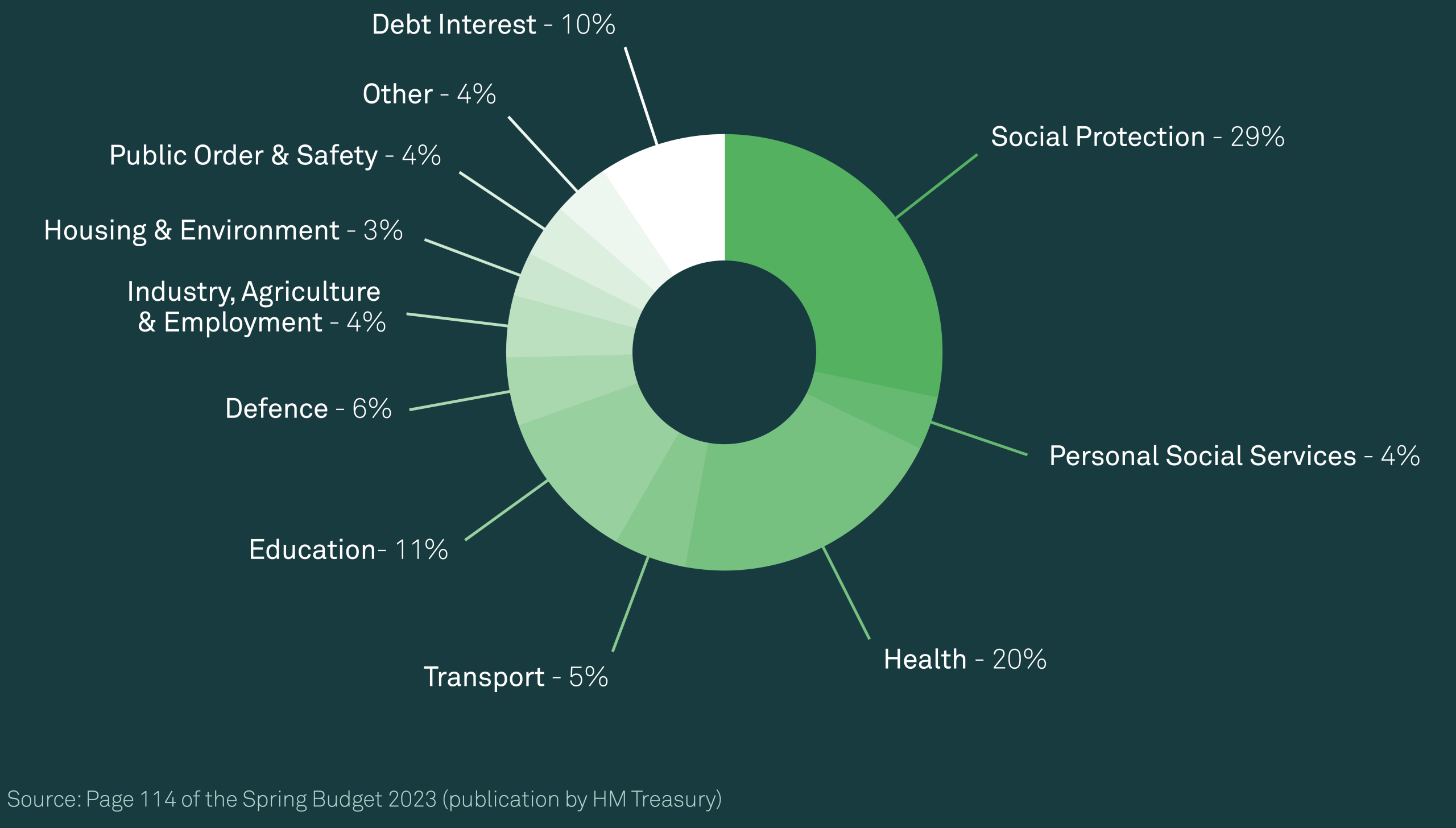

COMPONENTS OF UK GOVERNMENT SPENDING IN 2022-23

Total managed expenditure in 2022-23: £1,555 billion

PUBLIC SECTOR SPENDING IN 2023-24

Total managed expenditure in 2023-24: £1,189 billion

MAJOR SPENDING AREAS (APPROXIMATE PROPORTIONS)

- Health – 19%

- Pensions (state pension + pensioner benefits) – 12%

- Education – 10%

- Welfare & social protection – 23%

- Defence – 5%

- Debt interest – 10% (now one of the fastest-rising items)

- Transport & infrastructure – 4%

- Public order & safety – 4%

Two observations stand out:

- Debt interest is now a major tax consumer

Higher interest rates mean the government pays tens of billions simply to service existing debt.

- Public services are expensive and ageing demographics increase the pressure

More health costs. More pension costs. Fewer workers relative to retirees.

This structural squeeze is part of why tax rises were ultimately unavoidable.

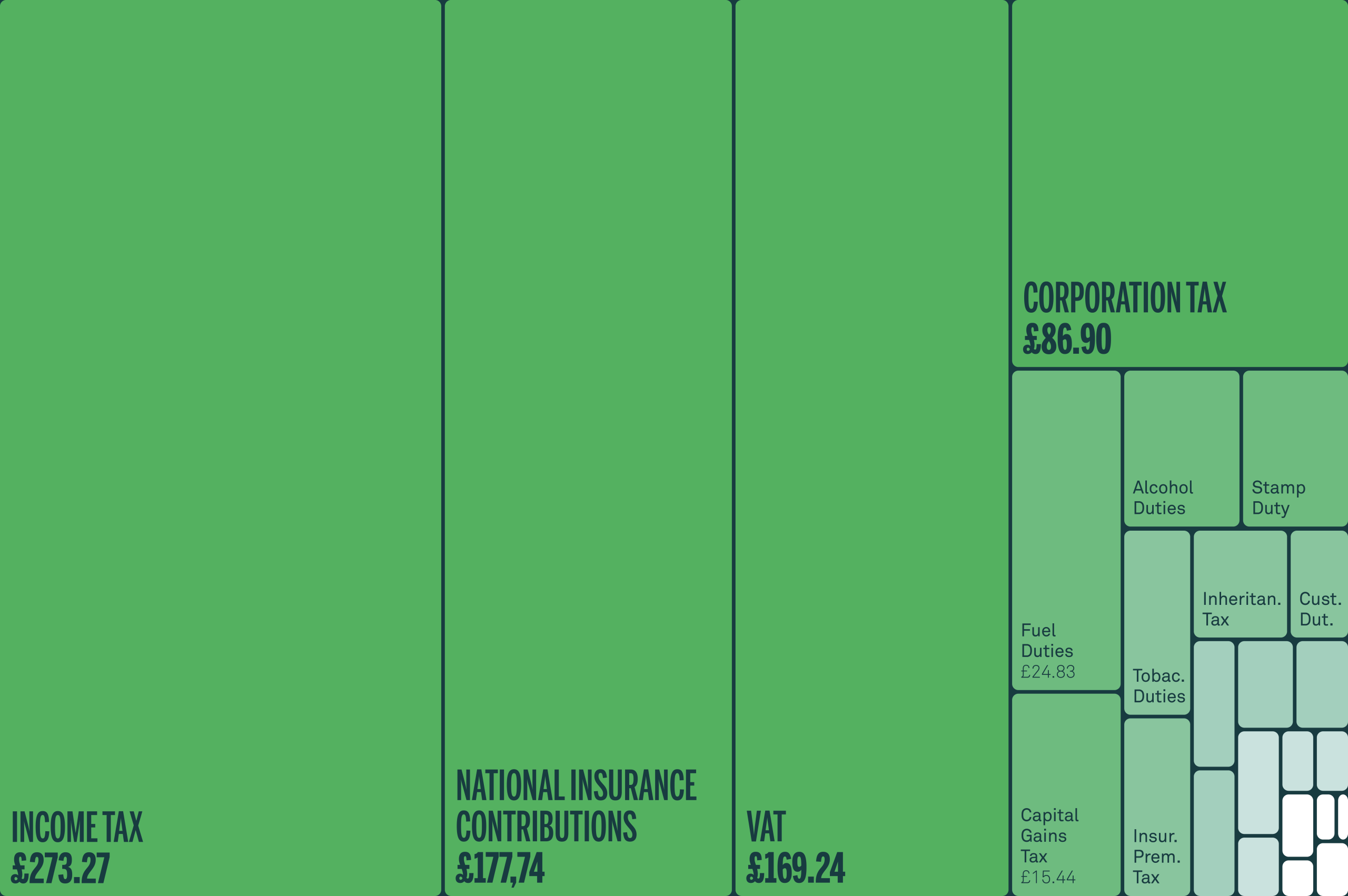

WHERE DO UK TAXES COME FROM?

The UK relies heavily on a few key sources of revenue:

HMRC TAX RECEIPTS 2023-24 (£BILLIONS)

MAIN TAX SOURCES

- Income Tax – 27%

- National Insurance – 18%

- VAT – 17%

- Corporation Tax – 6%

- Business Rates – 4%

- Stamp Duties – 2%

- Capital Gains Tax – 1%

- Inheritance Tax – 1%

Despite the political noise, IHT and CGT are tiny contributors and this is why governments often adjust them – they are politically symbolic but fiscally small.

The real money comes from taxing income, work, and consumption.

WHAT THIS MEANS FOR INVESTORS

- More Tax on Investment Returns

Higher taxes on dividends, savings and property directly reduce post-tax returns, making tax efficiency more important than ever.

- Threshold freezes mean ‘fiscal drag’

Even without policy changes, you end up paying more.

- Government borrowing will continue

The Budget does not mark a return to fiscal restraint.

Instead, it relies on future taxpayers to fund today’s commitments.

- Real returns matter more

Inflation + frozen thresholds = declining real wealth unless investments keep pace.

- Planning opportunities will need revisiting

Pensions – come in to IHT in April 2027.

ISAs – limits for the under 65s but still valuable.

Business Relief – an old area with renewed focus.

Gifting strategies – to limit future taxes as wealth passes to the next generation.

Trust structures – increasingly important as taxes rise.

CONCLUSION: THE PLASTER IS OFF – BUT THE PAIN IS COMING LATER

This Budget was designed for calm headlines today and rising tax revenues tomorrow.

For investors, the key message is this:

The UK is moving into a structurally higher-tax environment.

The impact will be felt gradually, but it will be material.

In that environment, proactive planning – not reactive decisions – will make the largest difference to long-term wealth.

Please contact NBL if you need to speak to us.